Whether you’re a fiscal advisor, investment issuer, or other economical Expert, check out how SDIRAs could become a robust asset to expand your small business and obtain your Skilled targets.

Better Expenses: SDIRAs normally have better administrative charges when compared to other IRAs, as specified components of the executive approach can't be automated.

Entrust can help you in paying for alternative investments with all your retirement resources, and administer the acquiring and selling of assets that are generally unavailable as a result of banking companies and brokerage firms.

Due Diligence: It really is called "self-directed" to get a purpose. Having an SDIRA, you happen to be fully accountable for totally exploring and vetting investments.

Criminals at times prey on SDIRA holders; encouraging them to open accounts for the goal of producing fraudulent investments. They usually idiot buyers by telling them that If your investment is acknowledged by a self-directed IRA custodian, it must be authentic, which isn’t accurate. All over again, Ensure that you do comprehensive due diligence on all investments you end up picking.

Simplicity of use and Technological know-how: A person-welcoming platform with on the web instruments to track your investments, post files, and manage your account is vital.

No, You can't invest in your own personal business with a self-directed IRA. The IRS prohibits any transactions involving your IRA and also your very own enterprise because you, as the owner, are regarded a disqualified individual.

Quite a few buyers are surprised to understand that employing retirement cash to speculate in alternative assets continues to be attainable considering the fact that 1974. Having said that, most brokerage firms and banking institutions give attention to presenting publicly traded securities, like shares and bonds, as they deficiency the infrastructure and knowledge to control privately held assets, such as real estate property or non-public fairness.

A self-directed IRA is really an unbelievably powerful investment car, nonetheless it’s not for everybody. Because the stating goes: view it with wonderful energy comes excellent responsibility; and with an SDIRA, that couldn’t be extra legitimate. see page Continue reading to discover why an SDIRA may, or may not, be to suit your needs.

SDIRAs are sometimes utilized by palms-on investors that are willing to take on the risks and obligations of choosing and vetting their investments. Self directed IRA accounts will also be perfect for investors who may have specialized understanding in a niche current market they want to spend money on.

Opening an SDIRA click now can present you with usage of investments Commonly unavailable via a lender or brokerage organization. Listed here’s how to start:

Think your Close friend may very well be commencing the subsequent Facebook or Uber? With the SDIRA, you may invest in triggers that you think in; and likely appreciate greater returns.

Higher investment choices indicates you may diversify your portfolio beyond shares, bonds, and mutual money and hedge your portfolio from market place fluctuations and volatility.

Once you’ve found an SDIRA service provider and opened your account, you may be questioning how to really get started investing. Understanding both of those The foundations that govern SDIRAs, as well as tips on how to fund your account, may also help to put the muse for the future of effective investing.

The primary SDIRA policies within the IRS that buyers need to have to be aware of are investment limitations, disqualified folks, and prohibited transactions. Account holders will have to abide by SDIRA principles and rules to be able to protect the tax-advantaged standing in their account.

Yes, real-estate is among our consumers’ hottest investments, in some cases referred to as a real estate property IRA. Customers have the option to take a position in all the things from rental Qualities, professional real estate, undeveloped land, property finance loan notes and much more.

Not like stocks and bonds, alternative assets tend to be tougher to sell or can come with rigid contracts and schedules.

This includes comprehension IRS laws, managing investments, and avoiding prohibited transactions that could disqualify your IRA. A scarcity of information could bring about high-priced problems.

Be in command of the way you increase your retirement portfolio by utilizing your specialized know-how and interests to speculate in assets that match with all your values. Acquired skills in property or private equity? Utilize it to guidance your retirement planning.

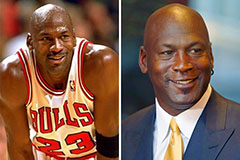

Michael Jordan Then & Now!

Michael Jordan Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!